Cryptocurrency, like Bitcoin, has been around for about a decade, and even though it has plenty of legitimate uses and has been embraced by a number of respectable companies, it has always been outside the mainstream of the financial world. But that might change now that a number of large companies, lead by Facebook but including financial giants like Visa and MasterCard are becoming players.

While this development could be positive, it also begs for scrutiny and, as you might expect, it’s already getting some from both Democratic and Republican leaders in Congress.

On Tuesday, Facebook announced that it’s launching a new subsidiary called Calibra, which will “let people access and participate in the Libra network.” While Calibra is a Facebook company, the Libra Network is a nonprofit association made up of about 30 companies.

The network, which will launch in 2020, will allow people to exchange money with individuals and businesses, for goods and services, and as a way of securing their money, similar to a checking account.

Digital wallet

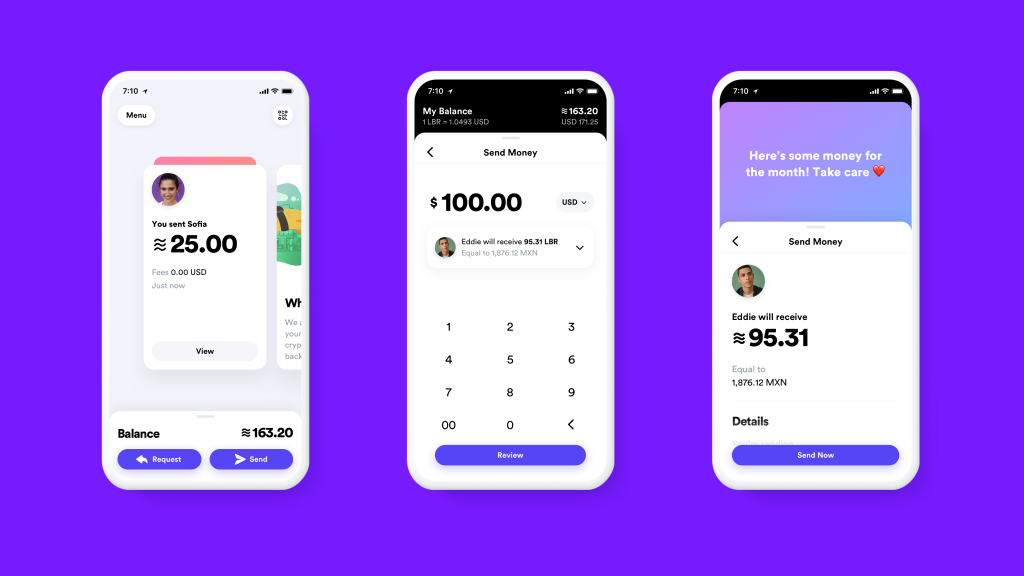

Facebook’s Calibra will create a “digital wallet” that works inside Facebook Messenger and WhatsApp and as a standalone app. The actual transactions will take place through the newly launched Libra Network, which is a nonprofit association of numerous companies including eBay, Paypal, Uber, Lyft and Spotify, along with the two major credit card networks. It’s reasonable to expect that there will be multiple apps from various companies for Libra transactions.

Libra’s goal, according to its website, is to create “a stable global cryptocurrency built on a secure network.” While it’s based on the same blockchain technology that powers Bitcoin and other cryptocurrencies, Libra is different than its predecessors in that it’s backed by a reserve of real assets. The organization behind Libra pledges that “a basket of currencies and assets will be held in the Libra Reserve for every Libra that is created, building trust in its intrinsic value.” The organization has also pledged to make it “stable,” meaning far less volatility than other cryptocurrencies, which has seen wild fluctuations in their value.

A Libra is a unit of currency, similar to the dollar, Euro and Pound. It even has it’s own symbol, depicted below.

Serving the unbanked

As Facebook pointed out in its announcement, “almost half of the adults in the world don’t have an active bank account and those numbers are worse in developing countries and even worse for women.” While most Americans have access to credit cards or debit cards and bank accounts, these services are not available to 1.7 billion people across the globe, even though a billion of those people do have access to a mobile phone and a half a billion of them have internet access, according to The Libra Association.

Facebook and e-commerce

Libra will make it possible for more people to participate in e-commerce by giving them a way to pay online even if they don’t have access to credit cards or bank accounts. It can also empower merchants around the world who may not have access to tools to collect money such as the ability to process credit or debit card payments.

It could be a huge source of revenue for Facebook if it can turn its social networking and messaging platforms into e-commerce platforms, allowing it to integrate e-commerce and payments into its other services.

A shot it the arm for cryptocurrency

This could finally be the catalyst that moves cryptocurrencies from the fringes of the internet and financial worlds to a mainstream way of exchanging money. Contrary to some (though by no means all) of the early uses of Bitcoin, such as processing payments for illegal drugs, weapons and other contraband items, Libra will launch as a legitimate platform backed by leading companies. And if they are successful in creating a stable currency backed by real assets, it will take much of the risk out of owning cryptocurrency, which will graduate from a speculative investment to a real way of exchanging value.

Of course, only time will tell if this scheme works and is widely adopted, but Libra is out-the-shoot with a promising pedigree.

Dissenting opinions in Congress

ZDNet reports that at least two members of Congress have already called for a pause in the Libra project. Congresswoman Maxine Waters (D-Los Angeles) who is chair of the House Financial Services Committee, put out a press release “requesting that Facebook agree to a moratorium on any movement forward on developing a cryptocurrency until Congress and regulators have the opportunity to examine these issues and take action. Facebook executives should also come before the Committee to provide testimony on these issues.”

Republican committee member Patrick McHenry agrees, and has called on Waters to hold a hearing on the matter.

Given Facebook’s history on privacy and security, it is understandable why policy makers would want to scrutinize its forays into the financial arena. And, because Libra is a type of currency, it’s ripe for federal scrutiny, especially from the Financial Services Committee, especially since the federal government is the one organization in the United States with the legal authority to, literally, print money. That’s not to say that the government should have monopoly on currency, any more than the U.S. Post Office should have a monopoly on delivering packages and envelopes. But, though Libra has the potential to do a lot of good, especially for the “unbanked,” it also has the potential to be misused as has sometimes been the case with other cryptocurrencies.

I’m not suggesting that Congress should try to block Facebook and its partners from moving forward, but I support shining a light on what these companies are doing to make sure that they are transparent while protecting the privacy and security of people who use this promising new currency.